Section 179 Tax Deduction

Automotive Tax Deductions for Small & Medium Businesses

Put yourself in a position to be successful. With Section 179 Tax Deductions, your business can enjoy great benefits courtesy of the federal government. When you're looking for a way to maximize your profits while minimizing your losses, this program is the perfect opportunity for you. O.C. Welch Ford Lincoln Inc. is proud to be your partner as you explore ways to improve your bottom line. Take advantage of Section 179 deductions and keep your eyes on the things that are most important.

What is Section 179?

Section 179 is a tax deduction the federal government offers, which allows small and medium-sized business owners to write off qualified purchases for certain depreciable assets. Section 179 lets business owners write off expenses immediately. This is a far cry from the previous approach when one could only write off the depreciation of a qualified asset over time, forcing you to extend your tax burden over several years.

If you desire to build a reliable and impressive fleet, we're happy to help. Section 179 deductions are a great tool to have in your corner. There are expectations that vehicles must meet to fall under the purview of this program. Section 179 employs the automobile's gross vehicle weight rating (GVWR) as a way to determine if it qualifies. In addition to the GVWR, the automobile must be used at least 50% of the time for business-related purposes. Let O.C. Welch Ford Lincoln Inc. help you examine the different categories based on GVWR.

- Light Section 179 Vehicles: Vehicles with a manufacturer's GVWR under 6,000 pounds. Includes passenger cars, crossovers, SUVs, and small utility trucks.

- Heavy Section 179 Vehicles: Vehicles with a manufacturer's GVWR of at least 6,000 pounds but no more than 14,000 pounds. Includes full-size SUVs, commercial vans, and pickup trucks.

- Other Section 179 Vehicles: Vehicles with a manufacturer's GVWR over 14,000 pounds or a vehicle modified for nonpersonal use.

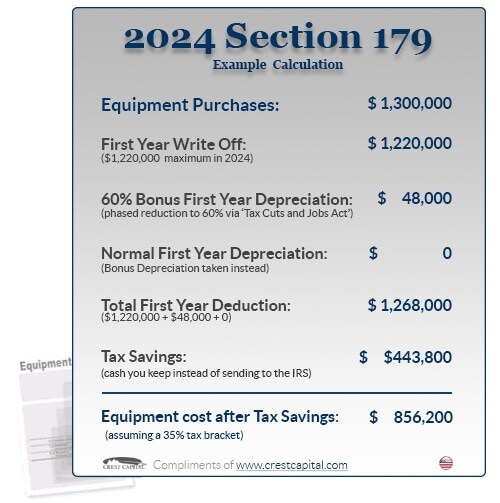

Section 179 offers up to $1,220,000 in deductions for the 2024 tax year. However, there are limits in place that one must know. Section 179 has a deduction limit of up to $30,500 for SUVs. Fortunately, you can still enjoy a great driving experience and build a fleet you will feel proud of when you shop at O.C. Welch Ford Lincoln Inc.

How It Works

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example). Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

And that's exactly what Section 179 does - it allows your business to write off the entire purchase price of qualifying equipment for the current tax year.

This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2024 tax return (up to $1,220,000).

All vehicles used for business purposes qualify for a deduction for depreciation - although most passenger vehicles are limited by a maximum 1st year depreciation deduction of $20,200 while other vehicles that by their nature are not likely to be used more than a minimal amount for business purposes, may not qualify for the full Section 179 Deduction (full policy statement available at IRS.gov). But trucks with a GVW above 6,000 are eligible for the full 100% of the purchase price deduction if they are utilized exclusively for business purposes.

Note: The deduction for business vehicles is the same whether they are purchased outright, leased, or financed.

Limits

General Limits

Section 179 does come with limits - there are caps to the total amount written off ($1,220,000 for 2024 ), and limits to the total amount of the equipment purchased ($3,050,000 in 2024 ). The deduction begins to phase out on a dollar-for-dollar basis after this limit is reached by a given business (thus, the entire deduction goes away once $4,270,000 in purchases is reached), so this makes it a true small and medium-sized business deduction.

Limits for SUVs or Crossover Vehicles with GVW above 6,000 pounds

Certain vehicles like SUV's and Crossovers (with a gross vehicle weight rating above 6,000 lbs. but no more than 14,000 lbs.) may qualify for Section 179 or Section 168(k) "Bonus Depreciation" allowing for a business to deduct up to 100% of the purchase price in the current tax year provided the vehicle is purchased and placed in service prior to January 1, 2024, and it meets other conditions.

Who Qualifies for Section 179?

What Ford & Lincoln Models are Eligible?

You can gain access to an amazing array of automotive options when you build your fleet through O.C. Welch Ford Lincoln Inc. With so many great vehicles to choose from, picking the one that best satisfies your business needs is easy. Take a look at the vehicles that are eligible for Section 179.

Ford Models

- Ford F-150® Trucks

- Ford F-250® & Ford F-350® Super Duty® Trucks

- Ford Expedition® & Ford Expedition MAX SUVs

Lincoln Models

- Lincoln Aviator®

- Lincoln Navigator®

Contact O.C. Welch Ford Lincoln Inc. to Learn More

Contact our commercial vehicle experts today to learn more about Section 179 Tax Deductions. At O.C. Welch Ford Lincoln Inc., your satisfaction is our priority. When it comes to building the perfect fleet for your business, our experts are happy to help. You can expect personalized, dedicated, and professional care that sets the bar higher than it's ever been before.

We'll help you through the financing process so that you have a clear understanding of the steps and benefits of financing through our dealership. If you have any questions about special offers or incentives, our team is here for you. Embrace a better way to shop when you choose O.C. Welch Ford Lincoln Inc. We look forward to serving you.

How can we help?

* Indicates a required field

-

O. C. Welch Ford Lincoln Inc.

4920 Independence Blvd

Hwy 278

Hardeeville, SC 29927

- Sales: (843) 288-0100